Our mission is to transform the lives of young people living in low-income, underserved communities through sport and physical activity.

Providing accessible and attractive sport and physical activity offers for young people

We believe that access to sport and its benefits are a right and not a privilege. For young people growing up in low-income, underserved communities, however, opportunities to play sport and be active are all too often either limited or non-existent.

To bridge this opportunity gap, we work closely with our network members and partners to unlock the multiple benefits that physical activity can offer to children and young people living in underserved communities.

Doorstep Sport is at the beating heart of what we do

Doorstep Sport is underpinned by the ‘five rights’: sport delivered at the right time, in the right place, in the right style, by the right people and at the right price.

We are the people beside the people who change lives and communities

Join thousands of other community organisations across the UK transforming young people’s lives through sport.

Support our work

Transforming young people’s lives through sport and physical activity requires partnership. That’s why we’re keen to hear from potential partners with ambition, commitment and a passion for creating healthier, safer, more successful communities through sport.

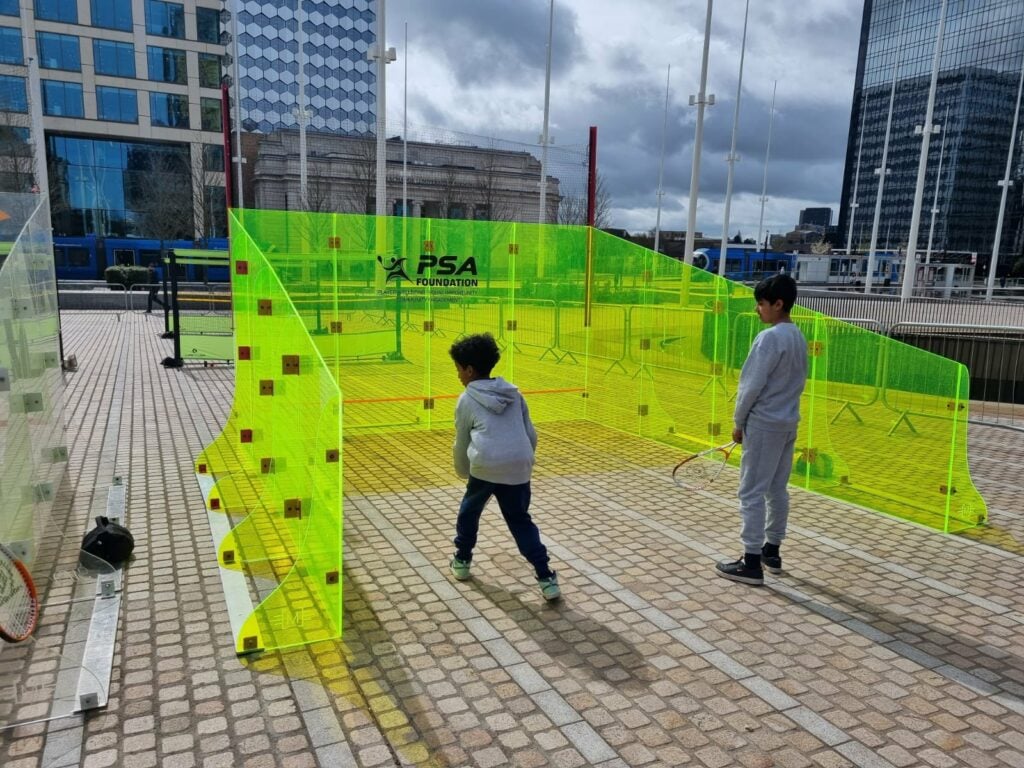

Inspiration Campaign

The ‘Inspiration’ campaign, launched in 2022, brings the buzz and benefits of major sporting events right to the doorstep of young people.. It achieves this through providing event tickets, partnering with National Governing Bodies for sports access and training, and offering volunteering opportunities for invaluable experiences and skills development.

Discover courses from our award-winning Training Academy

StreetGames training develops the workforce to activate change by building skills and knowledge in the areas of sport, physical activity, community safety, and mental and physical well-being. We work with organisations to build on talent and develop new areas of expertise. We deliver training to staff, students, apprentices, volunteers, youth workers and young leaders.

Explore our research and insights

Read our research and insights reports on what makes Doorstep Sport an effective approach and how it is making a real difference to young people’s lives.

StreetGames to me means an inclusive environment, where everybody has the same amount of access to sport no matter where you come from, who you are or how much money you have."

Read the latest thoughts and news from StreetGames

If you’d like to know what’s happening at StreetGames, why not take a look at our latest news and blog articles.